About Finance Parrot

At Finance Parrot, we help small businesses and startups get the funding they need — without the hassle.

Smarter Business Funding Starts Here

Every single day, thousands of new businesses are started in the U.S. — with over 5.5 million business applications filed in 2024 alone.

Today, there are more than 33.2 million small businesses across the country, driving innovation, creating jobs, and shaping communities.

But there's a problem...

Traditional Banks Are Failing Small Business Owners

Getting a business loan from a traditional bank is still frustratingly difficult. Business owners face:

- Endless paperwork

- Long wait times

- Rigid approval requirements

- And ultimately... high denial rates

In fact, over 1 in 5 small business owners were denied funding by traditional banks last year — and many more gave up after hitting red tape.

That’s Where Alternative Lending Comes In

The good news? You’re no longer limited to banks.

Alternative lending is booming, offering faster, easier, and more flexible funding solutions tailored to small business needs.

The global alternative lending market is projected to exceed $1 trillion by 2028, giving entrepreneurs more options than ever before to access capital without the traditional barriers.

Getting a Business Loan has Never been Easier

Apply in Minutes

Skip the paperwork and long wait times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere.

Get a Decision Right Away

No more guessing games. Once you apply, our system instantly matches you with the best funding options for your business.

Funding as Fast as Same Day

Need capital now? We work with lenders who can deliver funds to your account in as little as 24 hours.

What We Do at Finance Parrot

At Finance Parrot, we help small businesses and startups get the funding they need — without the hassle. We work with a trusted network of lenders who specialize in:

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Equipment Financing

Business loan to pay for new or used equipment like vehicles, machinery or technology.

SBA Loans

Business loans partially guaranteed by the U.S. Small Business Administration.

Merchant Cash Advance

Borrow money that repay via a percentage of your daily credit card sales.

Invoice Factoring

Get cash upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Explore More Options

Discover all the business loan options that are available to you.

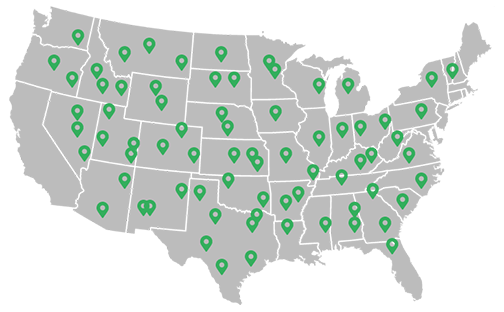

Recently Funded Businesses

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

Are small business loans hard to get?

No, small business loans aren’t hard to get as long as you have the right tools and resources. Here’s a list of what you need to do to increase your chances for approval:

- Know what lenders are looking for (revenue, collateral, personal and business credit score, and industry preferences)

- Decide on the type of loan for your business.

- Look for potential lenders and gather the necessary documents.

- Work with a financial advisor like SMB Compass. We’ll walk you through the entire process – from filling out the initial online application to submitting your application to our network of lenders to closing the deal.

What are the requirements to get a business loan?

Loan requirements vary depending on the lender you’re working with and the type of loan you’re applying for. Here’s what we usually look for from borrowers:

- 1-page online application

- 3 to 6 months’ worth of bank statement

- at least two years in business

What disqualifies you from getting a business loan?

In general, the factors that disqualify you from getting a loan are as follows:

- Limited cash flow

- Poor credit history

- Lack of a solid business plan

- A risky industry

- Insufficient collateral

- Insufficient time in business

- Missing documents or information

What’s the limit for a small business loan?

The loan limit depends on the type of loan you’re looking for.

- Business Line of Credit: $5,000,000

- Inventory Financing: $10,000,000+

- SBA Loans: $5,000,000

- Invoice Financing: $5,000,000

- Business Term Loans: $5,000,000

- Equipment Financing: 100% equipment value

- Purchase Order Financing: $10,000,000

- Bridge Loan: $5,000,000

- Asset-Based Loans: Up to $100,000,000

What is the minimum amount for a business loan?

The minimum loan amount depends on the type of financing you’re looking for.

- Business Line of Credit: $5,000

- Inventory Financing: $25,000

- SBA Loans: $50,000

- Invoice Financing: $25,000

- Business Term Loans: $100,000

- Equipment Financing: 100% equipment value

- Purchase Order Financing: $25,000

- Bridge Loan: $25,000

- Asset-Based Loans: Up to $100,000,000

How to choose the best lender for a small business loan?

The first step to choosing the right lender for you is to know what you need. How much money do you need to borrow? What do you need it for?

The next step is to research and compare different lenders. Verify their credibility by checking their rating on the Better Business Bureau, reading online reviews, and looking for upfront loan terms, an official website, and contact information.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.