Need a Small Business Loan

For Your Construction Company?

Whether you're taking on a bigger project, investing in new equipment, or bridging cash flow between jobs, our construction business loans give you the capital you need—without the bank headaches.

Getting a Business Loan For Your Construction Company has Never been Easier

Apply in Minutes

Tight deadlines and job site demands leave little time for paperwork. With Finance Parrot, you can apply online in just a few clicks—whenever it works for you.

Get a Decision Right Away

No more delays. Once you apply, we instantly match your construction business with the best funding options based on your needs.

Funding as Fast as Same Day

Need capital for materials, payroll, or new equipment? Our lending partners can fund your account in as little as 24 hours.

See Your Business Loan Options

Low Rates. Flexible Terms. Easy Process

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Equipment Financing

Business loan to pay for new or used equipment like vehicles, machinery or technology.

SBA Loans

Business loans partially guaranteed by the U.S. Small Business Administration.

Merchant Cash Advance

Borrow money that repay via a percentage of your daily credit card sales.

Invoice Factoring

Get cash upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Explore More Options

Discover all the business loan options that are available to you.

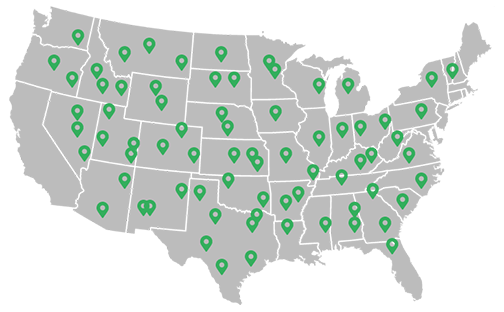

Recently Funded Construction Companies

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What types of loans are available for construction businesses?

Construction companies can access a variety of financing options, including working capital loans, equipment financing, business lines of credit, invoice factoring, SBA 7(a) loans, and short-term loans. Each serves a different purpose—from covering payroll during slow seasons to purchasing heavy machinery or managing upfront material costs.

Can I get a construction business loan with bad credit?

Yes, it’s possible. While traditional banks may require strong credit, many alternative lenders focus on your cash flow, project pipeline, and overall business performance. At Finance Parrot, we work with lenders who consider the full picture—not just your credit score.

How fast can I get funded?

Very fast. Once you apply, our system matches you with funding options instantly.

Many of our partners can deliver funds to your account in as little as 24 to 48 hours—perfect for when you need to order materials or secure a contract quickly.

What documents do I need to apply?

You’ll typically need:

A valid ID

Business bank statements (3–6 months)

Proof of business ownership

Basic financial statements (P&L, balance sheet, etc.)

Some lenders may request additional documents depending on the loan type and amount.

How can I use the funds from a construction loan?

Construction business loans are flexible. You can use the funds for:

Equipment purchases or rentals

Hiring skilled labor

Purchasing materials or supplies

Bridging cash flow between jobs

Expanding to new locations or projects

Do I need collateral?

Not always. Some loan types—like equipment financing—use the equipment itself as collateral. Others, like unsecured working capital loans or merchant cash advances, don’t require any collateral at all. We’ll help you find the best fit.

How do I apply through Finance Parrot?

It’s easy. Just fill out our quick online application. We’ll instantly match you with the best funding options tailored to your construction business. No multiple calls. No red tape.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.