Need a Small Business Loan

for Your Daycare?

Whether you're opening a new center, renovating classrooms, or covering payroll during slow seasons, our daycare business loans give you the capital you need—without the bank headaches.

Getting a Business Loan For Your Daycare Has Never Been Easier

Apply in Minutes

Running a daycare means your hands are full. Skip the paperwork and apply online in just a few clicks—whenever it fits into your busy day.

Get a Decision Right Away

No more wondering or waiting. Once you apply, we instantly match your childcare center with the best funding options available.

Funding as Fast as Same Day

Need funds for staffing, supplies, or a new play area? We work with lenders who can deposit funds in as little as 24 hours.

See Your Daycare Business Loan Options

Low Rates. Flexible Terms. Easy Process

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Equipment Financing

Business loan to pay for new or used equipment like vehicles, machinery or technology.

SBA Loans

Business loans partially guaranteed by the U.S. Small Business Administration.

Merchant Cash Advance

Borrow money that repay via a percentage of your daily credit card sales.

Invoice Factoring

Get cash upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Explore More Options

Discover all the business loan options that are available to you.

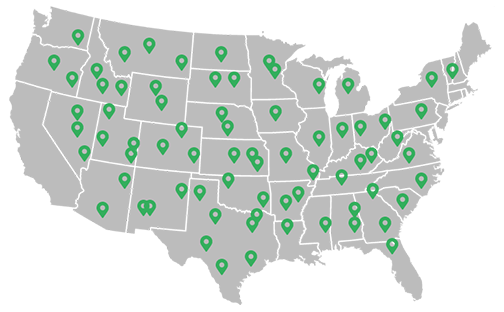

Recently Funded Daycares

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

Can I get a small business loan if my daycare is home-based?

Absolutely. Home-based daycare centers are eligible for various small business loans. Lenders will still look at factors like revenue, licensing, and business history—just like with traditional facilities.

What credit score do I need to qualify?

While traditional lenders prefer scores above 650, many alternative lenders work with scores as low as 500. Your credit score affects the terms and rates, but it’s not the only factor considered.

Can I use the loan to pay for licensing and insurance?

Yes. Many financing options, especially working capital loans and SBA microloans, can be used to cover licensing, insurance, and other operational costs.

How fast can I get funding?

Some lenders can approve and fund loans within 24–48 hours, especially if you have your documents ready. SBA loans take longer—typically 2–6 weeks—but offer better rates and terms.

What’s the difference between an SBA loan and a line of credit?

SBA loans offer low-interest, long-term financing for bigger projects.

Business lines of credit give you flexible access to funds for short-term needs—you only pay interest on what you draw.

I’m just starting out—can I still apply?

Yes, but options may be more limited. Startup daycare owners might qualify for SBA microloans, equipment financing, or personal-backed funding. A strong business plan helps boost approval chances.

Will I need to put up collateral?

It depends on the lender and loan type. Many working capital loans and lines of credit are unsecured, while SBA loans and equipment financing may require collateral like property or business assets.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.