Need a Small Business Loan

for Your Medical Practice?

Whether you're launching a new clinic, upgrading equipment, or expanding services, our medical practice loans give you the capital you need—without the bank headaches.

Getting a Business Loan for Your Medical Practice Has Never Been Easier

Apply in Minutes

Skip the paperwork and long approval times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere—even between patients.

Get a Decision Right Away

No more uncertainty. As soon as you apply, our system matches your medical or dental practice with the best funding options tailored to your needs.

Funding as Fast as Same Day

Need capital for new equipment, hiring staff, or expanding your clinic? We work with lenders who can deposit funds in as little as 24 hours.

Business Loans for Medical Professionals

Competitive Rates. Tailored Terms. Fast Approvals.

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Equipment Financing

Business loan to pay for new or used equipment like vehicles, machinery or technology.

SBA Loans

Business loans partially guaranteed by the U.S. Small Business Administration.

Merchant Cash Advance

Borrow money that repay via a percentage of your daily credit card sales.

Invoice Factoring

Get cash upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Explore More Options

Discover all the business loan options that are available to you.

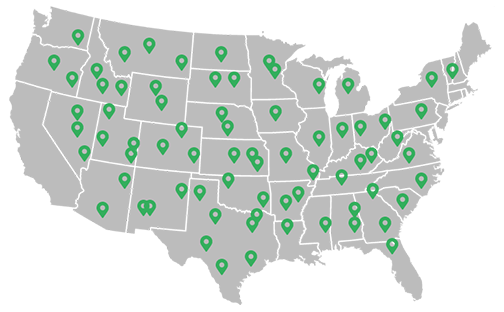

Recently Funded Medical Practices

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What types of small business loans are best for medical practices?

Medical practices often benefit from:

Working capital loans for day-to-day operations like payroll, rent, and supplies.

Equipment financing to cover the cost of diagnostic tools, exam tables, and more.

SBA 7(a) loans for larger expenses like expanding your clinic or acquiring another practice.

Business lines of credit for flexible access to cash during slower billing cycles.

Each option can support different needs depending on your practice’s growth stage and cash flow.

Can I get approved if I’m a new practice owner?

Yes—you don’t need decades in business to qualify. Many alternative lenders work with newer medical professionals, especially those with strong credentials or a well-prepared business plan. We’ll help you connect with the right lenders for your situation.

How fast can I get funded?

Once your application is complete, some lenders can fund in as little as 24 to 72 hours. If your loan type requires more documentation (like SBA loans), the timeline may be a few weeks. Either way, we streamline the process for you.

Will applying affect my credit score?

When you apply through Finance Parrot, we often start with a soft credit pull—so there’s no impact on your credit score just for checking your options. Only when you’re ready to move forward with a lender will a hard inquiry be made.

What can I use the loan for?

Common use cases include:

Purchasing new medical equipment

Renovating or expanding your clinic

Hiring additional staff or specialists

Managing cash flow between insurance reimbursements

Covering startup or relocation costs

If it supports your practice’s growth or stability, there’s likely a loan option that fits.

Do I need collateral to get a loan?

Not always. While some loans (especially higher amounts) may require collateral, many options—including unsecured loans and lines of credit—do not. We’ll help you identify the least burdensome path based on your goals.

What documents will I need to apply?

Typically:

Proof of medical credentials or licensing

Recent tax returns and bank statements

Profit & loss statements (if available)

Business plan (especially for newer practices)

Don’t worry—we’ll walk you through exactly what’s needed based on the loan type.

Why should I apply through Finance Parrot instead of directly with a bank?

Banks can be slow, rigid, and often say no. At Finance Parrot, we match your practice with vetted alternative lenders who understand the healthcare space—so you can get funded faster, with fewer hurdles, and better terms.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.