Need a Small Business Loan

for Your Restaurant?

Whether you're opening a new location, upgrading your kitchen, or managing cash flow, our small business loan for your restaurant give you the capital you need, without the bank headaches.

Restaurant Business Loans Made Simple

Challenges Restaurant Owners Face

Challenges Restaurant Owners Face

Running a restaurant, for example, comes with rising food costs, equipment needs, and the ongoing challenge of keeping your team and kitchen operating smoothly — all while managing thin profit margins.

How We Help

As a result, Finance Parrot is here to help food business owners like you gain fast access to restaurant business loans. Even if traditional banks have turned you down, we have options tailored to your needs.

Loan Options for Every Type of Restaurant

Whether you’re running a diner, food truck, café, or full-service restaurant, we’ll match you with the right loan option to grow your business — without the long wait.

How It Works

Apply in Minutes

✅ Apply in Minutes: No mountains of paperwork. Apply online in just a few clicks — right from your kitchen, office, or phone during prep.

Get a Decision Right Away

✅ Get a Decision Right Away: Forget waiting games. Instead, we instantly connect you with lenders who understand the pace and pressure of the restaurant industry.

Funding as Fast as Same Day

✅ Funding as Fast as Same Day: Whether it’s a broken fridge or a bulk inventory order — you could have capital in your account by tomorrow.

Your Restaurant Loan Options

Low Rates. Flexible Terms. Easy Process

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on what you use.

Equipment Financing

Get the tools you need. Use this loan to buy new or used equipment like kitchen appliances, vehicles, or POS systems.

SBA Loans

Partially guaranteed by the U.S. Small Business Administration — often with lower rates and longer terms.

Merchant Cash Advance

Borrow funds and repay them through a small percentage of your daily credit card sales — great for high-volume businesses.

Invoice Factoring

Need fast cash? Get upfront funding in exchange for unpaid invoices — up to 85% of their value.

Explore More Options

Discover all the business loan options that are available to you.

FAQs About Restaurant Financing

Can I get a restaurant loan with bad credit?

Yes. Many lenders we work with offer flexible credit requirements and focus more on your cash flow than your credit score.

How fast can I get funding?

Some loan approvals happen within 24 hours, and funding can arrive in 1–3 business days.

Is this only for traditional restaurants?

Not at all! We help cafés, food trucks, franchises, ghost kitchens, and more.

Use Our Free Loan Calculators

Want to estimate your payments? Use our tools to find the best loan structure for your restaurant.

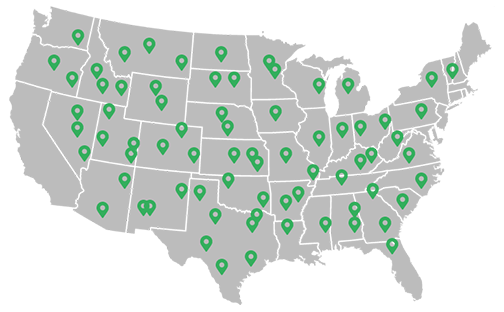

Recently Funded Restaurants

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What kinds of loans are best for restaurants?

Restaurants often benefit from:

Working capital loans to manage payroll, inventory, and rent—especially during slow seasons.

Equipment financing for commercial ovens, fridges, or kitchen upgrades.

Merchant cash advances for fast capital tied to future card sales (best for short-term needs).

Business lines of credit to smooth out cash flow dips or handle surprise repairs.

SBA 7(a) loans for major investments like remodeling, expanding, or acquiring a second location.

Each loan type has its strengths, and we’ll help you find the best fit.

Can I get approved if I have a seasonal or cash-heavy business?

Yes. Many lenders understand the ups and downs of the food business. Alternative lenders, in particular, offer more flexibility when it comes to cash-based or seasonal revenue. They may focus more on your daily deposits than just your credit score.

How quickly can I get funded?

Fast-track options like merchant cash advances or short-term loans can fund in as little as 24 to 48 hours. SBA loans take longer—typically a few weeks. Once you apply, we’ll guide you toward the fastest route that still makes financial sense.

Will applying affect my credit score?

Not right away. Finance Parrot uses soft credit pulls to assess your options—so there’s no impact just for checking rates. Only when you move forward with a specific lender will a hard inquiry be made.

What can I use the loan for?

You can use restaurant financing for:

Opening a new location

Renovating or upgrading your space

Purchasing kitchen or POS equipment

Hiring staff or launching marketing campaigns

Bridging seasonal dips in cash flow

Managing vendor invoices or bulk ingredient orders

Funds can be used for nearly any business expense related to your restaurant.

Do I need collateral?

Not necessarily. Many short-term loans, advances, and business lines of credit are unsecured. Higher amounts or longer-term SBA loans might require some form of collateral—but we’ll connect you with lenders who offer the least friction possible.

What documents do I need to apply?

You’ll usually need:

Bank statements (last 3–6 months)

Business license or registration

Tax returns and profit & loss statements

Lease agreement (for physical locations)

Credit score (personal and business, if available)

No need to track it all down alone—once you start your application, we’ll tell you exactly what’s needed.

Why should I apply through Finance Parrot?

Most banks don’t understand the pace and pressure of running a restaurant. At Finance Parrot, we specialize in matching restaurant owners with lenders who move fast, offer flexible terms, and get the unique financial rhythms of hospitality.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.