Need a Small Business Loan

for Your Trucking Company?

Whether you're adding new trucks, covering fuel and maintenance costs, or navigating slow-paying clients, our trucking business loans give you the capital you need—without the bank headaches.

Getting a Trucking Business Loan Has Never Been Easier

Apply in Minutes

Skip the long forms and faxes. Trucking doesn’t stop, and neither should you. With Finance Parrot, you can apply online in just a few clicks—whenever and wherever works for you.

Get a Decision Right Away

No more waiting around. As soon as you apply, we match your trucking business with top funding options—so you know exactly where you stand, fast.

Funding as Fast as Same Day

Need cash for fuel, repairs, or a new load? We work with lenders who understand the industry and can fund your account in as little as 24 hours.

See Your Trucking Business Loan Options

Low Rates. Flexible Terms. Easy Process

Business Line of Credit

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Equipment Financing

Business loan to pay for new or used equipment like vehicles, machinery or technology.

SBA Loans

Business loans partially guaranteed by the U.S. Small Business Administration.

Merchant Cash Advance

Borrow money that repay via a percentage of your daily credit card sales.

Invoice Factoring

Get cash upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Explore More Options

Discover all the business loan options that are available to you.

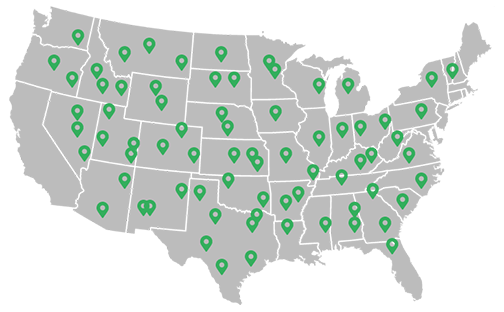

Recently Funded Trucking Companies

We'll Help You Get the Right Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What types of small business loans are available for trucking companies?

You have several great options depending on your goals:

Equipment financing for purchasing trucks or trailers.

Working capital loans to cover everyday expenses.

Lines of credit for flexible access to cash during slow periods.

SBA 7(a) loans for long-term growth or expansion.

Invoice factoring to smooth out cash flow when waiting on payments.

Each comes with different rates, terms, and requirements—Finance Parrot helps match you to the right fit fast.

What can I use the loan for?

Most trucking business loans can be used for:

Buying or repairing trucks

Fuel and payroll costs

Insurance and permits

Expanding your fleet

Marketing or growing routes

Covering unexpected repairs or slow-paying clients

We’ll help you find funding that aligns with your business goals.

How fast can I get funded?

Some lenders we work with can deliver funds in as little as 24 to 48 hours—especially for short-term working capital or equipment financing. More complex loans, like SBA options, may take longer but offer better terms.

Do I need perfect credit to qualify?

Not necessarily. While stronger credit helps, many trucking company owners qualify with average or even challenged credit. Alternative lenders look at the bigger picture—like revenue, time in business, and contracts on hand.

How do I qualify for a trucking business loan?

Eligibility requirements vary by lender, but most look for:

6+ months in business

Monthly revenue of at least $10,000

U.S.-based operations

Bank statements or financial records

We’ll guide you through what documents you’ll need and help make the process simple.

What’s the difference between traditional and alternative lending?

Big banks often have stricter requirements and slower approval times. Alternative lenders (like the ones we work with) offer faster decisions, more flexible terms, and funding options tailored for real-world operators like you.

Will I need to put up my trucks as collateral?

It depends on the loan type. Equipment financing typically uses the vehicle you’re buying as collateral. Other loans may be unsecured or require a personal guarantee. We’ll help you understand the risks and rewards.

Can I get a loan if I’m an owner-operator or have a small fleet?

Absolutely. Whether you’re a one-person show or managing a growing fleet, there are funding options for you. Many alternative lenders cater specifically to owner-operators and small logistics businesses.

What makes Finance Parrot different from other business loan sites?

We specialize in matching small businesses—especially capital-heavy industries like trucking—with trusted alternative lenders. That means:

No spammy brokers

One secure application

Real funding, real fast

Think of us as your smart shortcut to serious funding.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.