Need a Bridge Loan

For Your Business?

A bridge loan for your business is a short-term financing solution designed to help you cover temporary cash flow gaps, manage property transitions, or wait for long-term funding. If you need fast, flexible capital without the hassle of traditional banks, a bridge loan can help bridge the gap.

Getting a Bridge Loan Has Never Been Easier

Timing is everything in business—and sometimes, the cash you need just isn’t there when you need it. Whether you're waiting for long-term financing, a property sale, or incoming revenue, a bridge loan can help fill the gap. Our bridge loan solutions give you fast, short-term access to capital so you can move forward without delays.

Apply in Minutes

Skip the paperwork and long wait times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere.

Get a Decision Right Away

No more guessing games. Once you apply, our system instantly matches you with the best funding options for your business.

Funding as Fast as Same Day

Need capital now? We work with lenders who can deliver funds to your account in as little as 24 hours.

See Your Bridge Loan Options

Low Rates. Flexible Terms. Easy Process

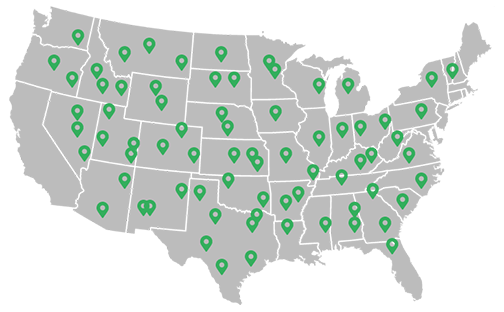

Recently Funded Businesses

We'll Help You Get a Bridge Loan

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What is a bridge loan?

A bridge loan is a short-term financing option used to “bridge the gap” between now and a future event—like the sale of a property, finalizing long-term financing, or closing a major deal. It gives businesses quick access to capital when timing is critical.

How does a bridge loan work?

Bridge loans provide immediate funds that are typically repaid once your expected financing or payment comes through—such as proceeds from a real estate sale or an incoming loan. They’re often interest-only and designed for short-term use, usually 6 to 24 months.

Who should use a bridge loan?

Bridge loans are ideal for:

Real estate investors waiting to sell or refinance

Business owners acquiring another company

Developers waiting on construction or permanent financing

Companies facing urgent but temporary cash flow gaps

How much can I borrow with a bridge loan?

Loan amounts can range from $25,000 to several million dollars, depending on the lender, your collateral, and your financial profile.

How fast can I get funding?

Fast. Many businesses get approved within 24 hours and receive funds shortly after. Once approved, you can purchase the equipment and get to work with minimal delay.

What are the typical terms of a bridge loan?

Terms vary by lender, but most bridge loans offer:

Short repayment periods (6–24 months)

Interest-only payments

Competitive rates for strong borrowers

Collateral-backed financing (often real estate or business assets)

Do I need collateral for a bridge loan?

Yes, most bridge loans require some form of collateral, such as real estate, business assets, or outstanding invoices. The strength of your collateral directly affects your loan terms.

Can I get a bridge loan if I have bad credit?

It’s possible. Because bridge loans are often asset-backed, some lenders are more flexible on credit scores—especially if your exit strategy (repayment plan) is solid.

How do I apply through Finance Parrot?

Just fill out our quick online application. We’ll match you with equipment financing options tailored to your business—without the paperwork overload or endless broker calls.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.