Need Invoice Factoring

For Your Business?

Invoice factoring for your business is a fast way to unlock cash tied up in unpaid invoices. Improve cash flow, keep operations running smoothly, and avoid the delays of traditional financing.

Getting Invoice Factoring Has Never Been Easier

Waiting weeks, or even months, for clients to pay their invoices can put your business in a financial bind. Our invoice factoring solution helps you turn those unpaid invoices into immediate working capital, so you can cover expenses, manage operations, and grow without waiting. No complicated processes, no long approvals—just fast access to the funds you’ve already earned.

Apply in Minutes

Skip the paperwork and long wait times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere.

Get a Decision Right Away

No more guessing games. Once you apply, our system instantly matches you with the best funding options for your business.

Funding as Fast as Same Day

Need capital now? We work with lenders who can deliver funds to your account in as little as 24 hours.

See Your Business Loan Options

Low Rates. Flexible Terms. Easy Process

Loan Amounts

$25,000 - $5,000,000

Rates

Starting at 5.99%

Speed

24 - 48 Hours

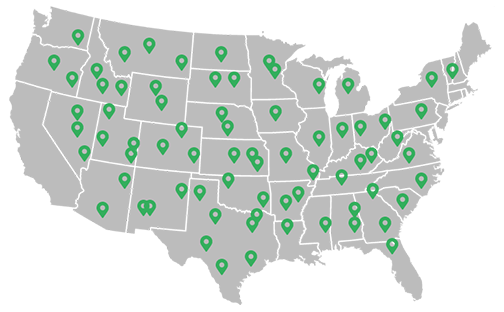

Recently Funded Businesses

We'll Help You Get Invoice Factoring

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What is equipment financing?

Equipment financing is a type of small business loan specifically used to purchase or lease equipment—like vehicles, machinery, computers, or commercial appliances. The equipment typically serves as collateral, making approval faster and easier for many businesses.

Who is equipment financing best for?

It’s ideal for any business that needs to acquire tools, technology, or machinery to operate or grow. This includes construction companies, restaurants, trucking fleets, medical practices, manufacturers, and more.

Can I qualify with bad credit?

Yes. Because the equipment itself secures the loan, many lenders are more flexible with credit requirements. If your business has consistent cash flow, you may still qualify even with less-than-perfect credit.

What types of equipment can I finance?

Almost anything your business needs to operate:

Trucks, trailers, and commercial vehicles

Medical and dental equipment

Restaurant appliances and POS systems

Construction machinery

Computers, servers, and office tech

Manufacturing and industrial tools

How fast can I get funding?

Fast. Many businesses get approved within 24 hours and receive funds shortly after. Once approved, you can purchase the equipment and get to work with minimal delay.

What documents are needed to apply?

Most lenders require:

A valid ID

Business bank statements (3–6 months)

Equipment quote or invoice

Business license or proof of ownership

Additional documents may be requested depending on your loan amount and lender.

Do I need to make a down payment?

It depends. Some lenders offer 100% financing, while others may require a small down payment (typically 5–20%). We’ll help you find the best option for your budget.

Is leasing better than financing?

That depends on your goals. Leasing offers lower upfront costs and more flexibility, while financing gives you ownership and potential tax benefits. Not sure which to choose? We can walk you through it.

How do I apply through Finance Parrot?

Just fill out our quick online application. We’ll match you with equipment financing options tailored to your business—without the paperwork overload or endless broker calls.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.