Need a SBA Loan

For Your Business?

Whether you're replacing aging machinery, upgrading to newer tech, or expanding your operations, our equipment financing gives you the capital you need—without the bank headaches.

Getting SBA Loans Has Never Been Easier

We've simplified the process to help business owners like you access government-backed funding without the usual delays and confusion. With guided support, streamlined paperwork, and a focus on speed, you can secure the capital you need to grow, hire, expand, or simply keep operations running smoothly. It’s smarter financing—made accessible, efficient, and designed around your business goals.

Apply in Minutes

Skip the paperwork and long wait times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere.

Get a Decision Right Away

No more guessing games. Once you apply, our system instantly matches you with the best funding options for your business.

Funding as Fast as Same Day

Need capital now? We work with lenders who can deliver funds to your account in as little as 24 hours.

See Your Business Loan Options

Low Rates. Flexible Terms. Easy Process

Loan Amounts

$25,000 - $5,000,000

Rates

Starting at 5.99%

Speed

24 - 48 Hours

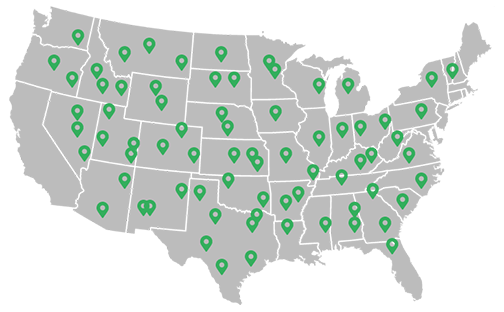

Recently Funded Businesses

We'll Help You Get SBA Loans

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What is an SBA loan?

An SBA loan is a government-backed business loan partially guaranteed by the U.S. Small Business Administration. It’s designed to help small businesses access affordable funding with competitive terms through approved lenders.

What are the most common types of SBA loans?

The most common SBA loan programs include:

SBA 7(a) Loan – For general business use, working capital, or expansion

SBA 504 Loan – For purchasing commercial real estate or large equipment

SBA Microloan – Smaller loans (up to $50,000) for startups and smaller needs

How much can I borrow with an SBA loan?

Loan amounts vary based on the program:

SBA 7(a): Up to $5 million

SBA 504: Up to $5.5 million

SBA Microloans: Up to $50,000

What can SBA loans be used for?

SBA loans can be used for:

Working capital

Business expansion

Equipment or inventory

Real estate purchases

Refinancing debt

Buying another business

How fast can I get funding?

Fast. Many businesses get approved within 24 hours and receive funds shortly after. Once approved, you can purchase the equipment and get to work with minimal delay.

What documents are needed to apply?

Most lenders require:

A valid ID

Business bank statements (3–6 months)

Equipment quote or invoice

Business license or proof of ownership

Additional documents may be requested depending on your loan amount and lender.

Do I need to make a down payment?

It depends. Some lenders offer 100% financing, while others may require a small down payment (typically 5–20%). We’ll help you find the best option for your budget.

Is leasing better than financing?

That depends on your goals. Leasing offers lower upfront costs and more flexibility, while financing gives you ownership and potential tax benefits. Not sure which to choose? We can walk you through it.

How do I apply through Finance Parrot?

Just fill out our quick online application. We’ll match you with equipment financing options tailored to your business—without the paperwork overload or endless broker calls.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.