Need Startup Financing

For Your Business?

Whether you're launching your first product, hiring your initial team, or building out your space, our startup funding gives you the capital you need to get off the ground—without the bank headaches.

Getting Startup Financing Has Never Been Easier

Starting a business takes more than just a great idea—it takes capital. But as a new business, you might not always have the cash on hand when you need it most. That’s where we come in. Our startup funding solutions help entrepreneurs secure the resources they need to launch, build, and grow—without the delays and red tape of traditional banks.

Apply in Minutes

Skip the paperwork and long wait times. With Finance Parrot, you can apply online in just a few clicks—anytime, from anywhere.

Get a Decision Right Away

No more guessing games. Once you apply, our system instantly matches you with the best funding options for your business.

Funding as Fast as Same Day

Need capital now? We work with lenders who can deliver funds to your account in as little as 24 hours.

See Your Business Loan Options

Low Rates. Flexible Terms. Easy Process

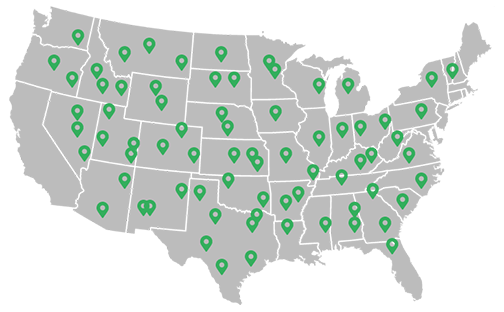

Recently Funded Businesses

We'll Help You Get Startup Financing

Get approved today and have money in your account within as little as 24 hours. No obligation — prequalify without affecting your credit!

Common Questions. Straight Answers.

What is startup funding?

Startup funding refers to capital provided to new businesses that are in the early stages of development. It helps cover essential startup costs like equipment, inventory, marketing, payroll, and more—before the business is generating consistent revenue.

Can I get funding if my business hasn’t started yet?

Yes. Many funding options are available for pre-revenue startups, especially through alternative lenders. While you may not qualify for traditional bank loans, options like unsecured business loans, equipment financing, and startup lines of credit are available based on your credit, business plan, or collateral.

How much funding can I qualify for?

Startup funding amounts typically range from $5,000 to $150,000 or more, depending on your personal credit, the strength of your business plan, industry type, and available assets (if any).

What can startup funding be used for?

Startup funding can help cover:

Business registration and licensing fees

Inventory and supplies

Equipment or technology

Marketing and advertising

Hiring your first employees

Office, retail, or warehouse space

Website or app development

There are few restrictions—as long as the funds are used for legitimate business purposes.

Do I need a business plan to apply?

Some lenders may require a business plan—especially if you’re a pre-revenue startup with no operating history. A solid business plan can improve your chances of approval and help clarify how you intend to use the funds.

Can I get funding with bad credit?

Yes, it’s possible. While good credit improves your chances, some startup funding programs are available to founders with fair or limited credit history, especially if you have collateral or a strong co-signer.

Do I need to provide collateral?

Not always. Some startup funding options are unsecured, meaning no collateral is required. Others may require collateral like equipment, vehicles, or personal assets, depending on your application profile.

How do I apply through Finance Parrot?

Just fill out our quick online application. We’ll match you with equipment financing options tailored to your business—without the paperwork overload or endless broker calls.

The information contained in this website is for general information purposes only. The information is provided by Finance Parrot and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.